BUSINESS PLAN

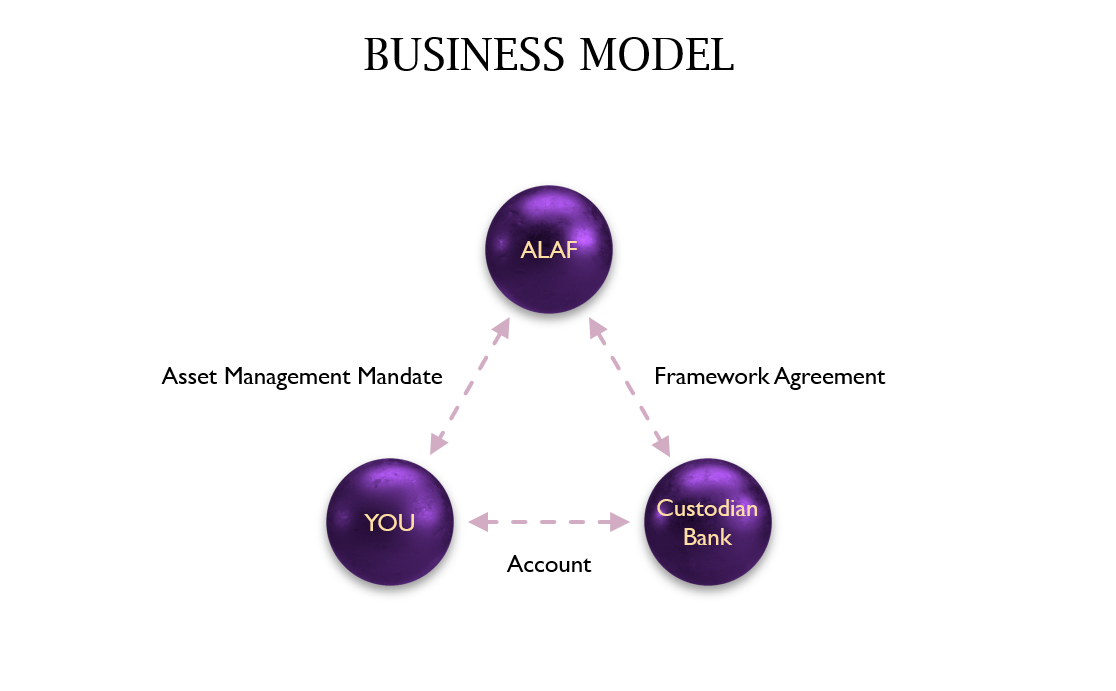

Unlocking the path to successful wealth management. Our Business Model is designed to bridge the gap between clients and custodian banks, ensuring efficient and secure asset management.

With tailored mandates, specialized account setups, and meticulously crafted Model Portfolios, we prioritize your unique needs and goals. Immerse yourself in our strategic vision, where comprehensive and personalized financial solutions take center stage, prioritizing regulatory compliance and transparency.

ALAF Capital's Business Model bridges clients and custodian banks, enabling efficient and secure asset management.

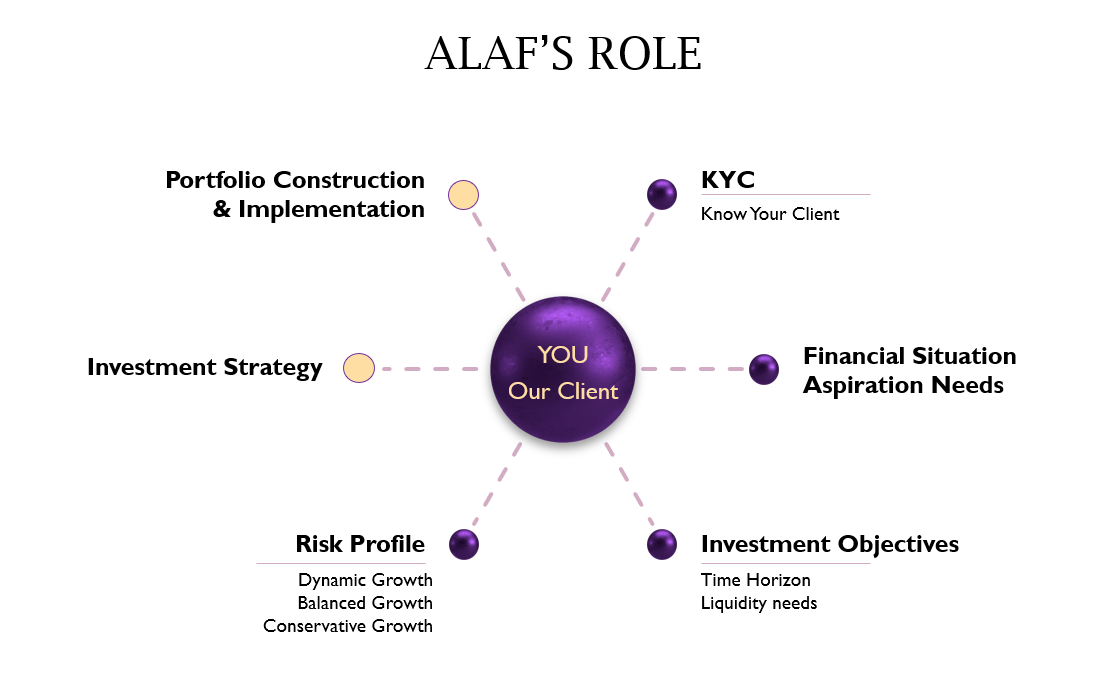

We provide comprehensive and personalized financial solutions to meet each client's unique needs. We dedicate exclusive focus and extra attention to private individuals and deploys sophisticated tools and techniques to manage their wealth. We deliver customized investment strategies with the objective of enhancing performance through a personalized, comprehensive, and transparent approach.

MODEL PORTFOLIOS

A Model Portfolio is a pre-designed and well-defined investment strategy tailored to each client's specific needs and goals. The tailor-made investment portfolio focuses on your : goals, financial obligations, needs, time range and risk appetite.

It is carefully designed to meet your unique needs and goals. ALAF relies on thorough analysis of the current economic climate, market trends, and best practices in asset diversification to develop these portfolios.

Here are the following pre-designed portfolios :

CONSERVATIVE

This strategy aims at long-term capital preservation, while generating an income. This strategy is adapted to an investor with a moderate or even low tolerance for potential risks of loss and annual volatility of the Assets.

The investment time horizon is relatively short, that is, generally, less than three years.

BALANCED

This strategy aims at moderate long-term capital growth, while generating a regular income. This strategy is adapted to an investor having an average tolerance for potential risks and annual volatility of the Assets.

The investment time horizon is in the medium term, that is, generally, between three and six years.

DYNAMIC

This strategy aims at substantial long-term capital growth, notably by means of capital gains. This strategy is adapted to an investor having a high tolerance for potential risks of loss and annual volatility of the Assets.

The investment time horizon is relatively long, that is, generally, more than six years.